Recent arrests by the U.S. government, as reported by Reuters last week, might be the first case of charging someone for smuggling a "greenhouse gas.” But HFCs are also Ozone Depleting Substances (ODSs), controlled under the Montreal Protocol. Throughout the 1990s, ODS smuggling across the US/Mexico border regularly ranked as the #2 smuggling charge--after drugs--year after year.

That is an artifact of the unique way the US has applied most pollution reduction regs, going back to the 1960s, and continues to do so to this day.

If/when we ever got serious about removing a pollution precursor from our supply chains--whether we were talking about lead in gasoline or paint, ozone-depleting substances in refrigerant chemicals and insulation materials, asbestos, sulfur in diesel and the coal we use to make electricity, etc.--the U.S. has typically built a loophole into the US regs, which purposefully subsidizes U.S. firms, at least for a while, by providing room to continue business-as-usual practices.

And the US loophole almost always creates an incentive for smuggling. The loophole in the US regs differentiates between products that are produced and sold in the domestic market and those that US producers export. Most of the time, when it comes time to get serious about ordering pollution precursors out of what gets sold domestically, other nations order the coincident phase out of the pollution precursor content in all production and sales—including exports.

When it came to getting the lead out of gasoline, Canada, for example, ordered Canadian refiners and distributors to phase lead out of the gasoline they produced in Canada, as well as in all the gasoline they sold into both domestic and foreign markets. Thus, in the lead phase-out regulation, "sales" covered both domestic and export market sales.

But--as has been the case in most US pollution reduction precedents--in 1978 the US regulated only the phase out of lead in US domestic gasoline sales. US refiners were not ordered to stop producing leaded gasoline and were encouraged to export leaded gasoline to those countries that had not yet enacted their own low-lead gasoline regulations.

The US was a net gasoline importer for 30 years prior to the introduction of the domestic leaded gasoline phase out order. From 1980-1990, during the domestic lead phase out, the US refining sector grew to be a net exporter of gasoline. They made money on their leaded fuel production capacity by marketing leaded gasoline to developing nation markets (mostly South America in this case), while they were building the capacity to produce unleaded fuel to meet the new reg-driven domestic demand. You can see a repeat of this procedure in the US implementation of their low-sulfur diesel standard.

The US government did not order the phase out of US leaded gasoline production capacity--and, indirectly, leaded fuel exports--until 1995. Once the US refiners had established developing nation gasoline market shares by ‘dumping’ leaded gasoline into those markets, they then slowly substituted unleaded fuel to maintain those export market shares.

Both the oil industry and US government justified the marketing of leaded fuels into developing economies on the theory that these economies needed cheaper fuel to faster develop and that, as long as those economies are underdeveloped, the value of the life of a healthier child was outweighed by the cheap leaded gasoline-fueled accelerated rate of economic development.

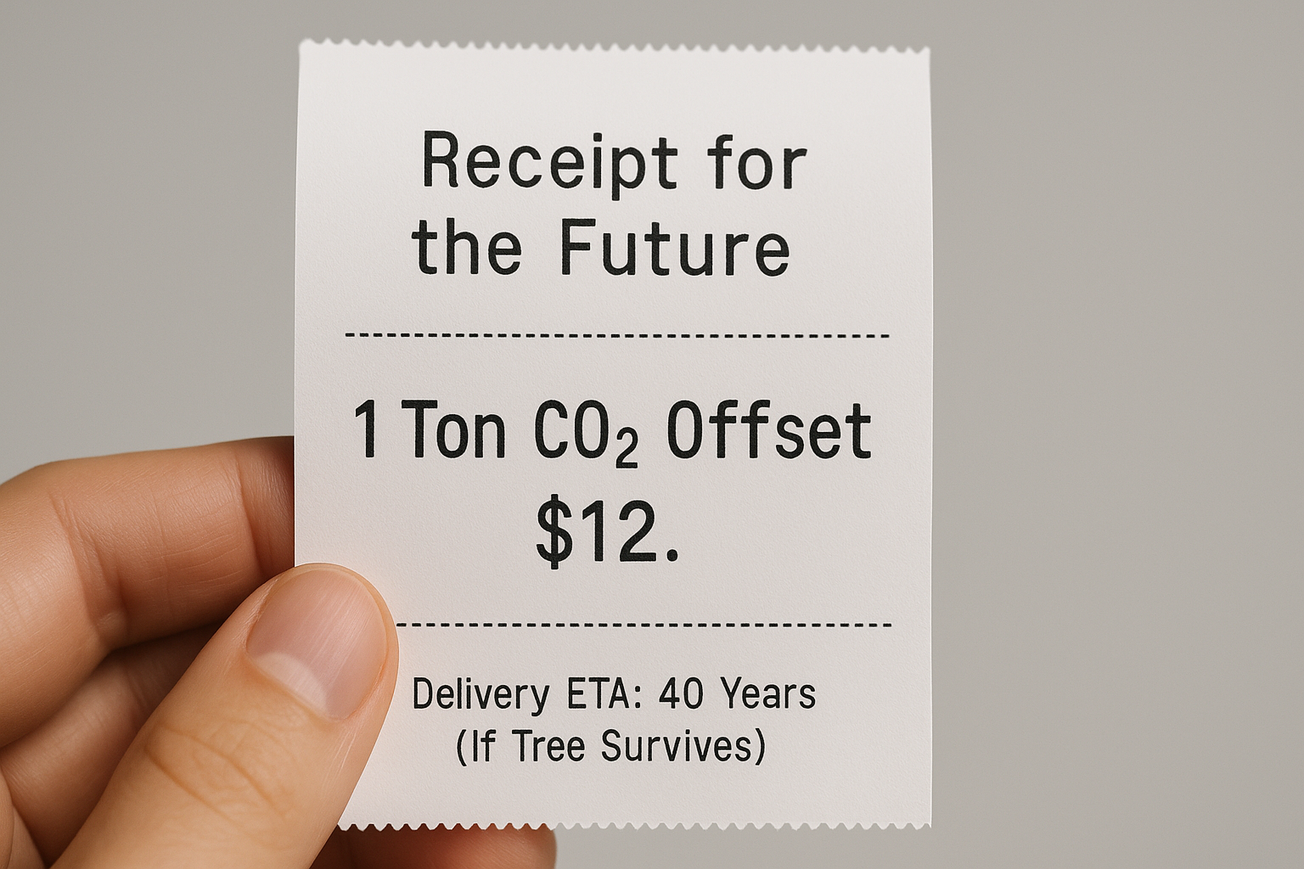

Similarly, it remained legal for US producers to export ODSs long after it was illegal to sell those ODSs in the U.S., or to import ODS-bearing chemicals into the U.S. The return on smuggling ODSs into the U.S. was a function of the U.S. regulation that banned domestic production and imports, but not exports, combined with gameable and difficult to enforce product source reporting and tracing rules. There is a risk that we are currently seeing the construction of a set of rules that will form the foundation for similarly damaging export-plus-smuggling behavior across the broader international carbon dioxide markets (not just with respect to ozone depleting substances that are also greenhouse gases).

We need to stop this practice and finally close that door. We need to get it right when it comes to reporting and managing the trade in goods and services whose production and end use results in the transfer of heat-trapping gases to the atmosphere.

And while we are trying to get this right, we should also remember that the first U.S. emission "cap and trade" rule was introduced in the context of the leaded gas phase out. In that—and, so far, every subsequent—U.S. cap & trade precedent, the allowance supply never imposed a material cap on emissions. Actual mandates to reduce emissions were embedded in traditional command-and-control regulations that were adopted coincident with the emissions allowance trading scheme.

For example, take a look at Table 2 on page 17 in the original California 2008 Climate Change Scoping Plan. Of the 174 million TCO2e/year reduction the state set as their 2020 target, 0.3 million TCO2e was attributed to the cap and trade rule, 34.4 million TCO2e were still to be found, and the rest—139.3 million TCO2e/year were attributed to planned command and control regulations. U.S. emission allowance trading regimes have always been keys to trade protectionism. This is no less true in the current GHG context than in the leaded gasoline phase out or the Acid Rain Program electricity sector SO2 phase out, or the CO2 cap & trade rule that is in effect in California today.

The bridge the U.S. traditionally builds to get from a brown to green economy is always—so far anyway--built on a foundation of command-and-control regulations. "Cap & trade" is just the toll system that is mounted on the bridge after it is built. Preferred companies--those who create jobs and add value within U.S. boundaries--get free passes to use the bridge, even if they are brown service providers. Outside suppliers of goods and services have to pay full tolls for access to the protected "green" economy, even when the goods and services they deliver are greener than those produced within U.S. boundaries.

This might be an acceptable policy package if it was the only way to go, and we have no choice but to accept an unprecedented era of heightened trade wars as the price we have to pay to get atmospheric concentrations of heat-trapping gases down. But there is a better way. We have proved that in the past. Let’s not choose to go down the trade war path on GHG emissions.