Establishing effective carbon markets should be a foundational solution to mitigating climate change risk. But the 20+ year-old effort to launch effective carbon markets has encountered significant challenges, exposing fundamental flaws that demand urgent attention. Recent analyses reveal alarming discrepancies in the efficacy of both voluntary (“VCM”) and government-administered (“compliance”) carbon markets, raising doubts about the true impact of these initiatives on global emissions reduction efforts. Strangely, most of the media reporting is about bogus credits that trade in the VCMs, when CO2 allowances minted by governments and traded in compliance markets can be as, or more, unreliable.

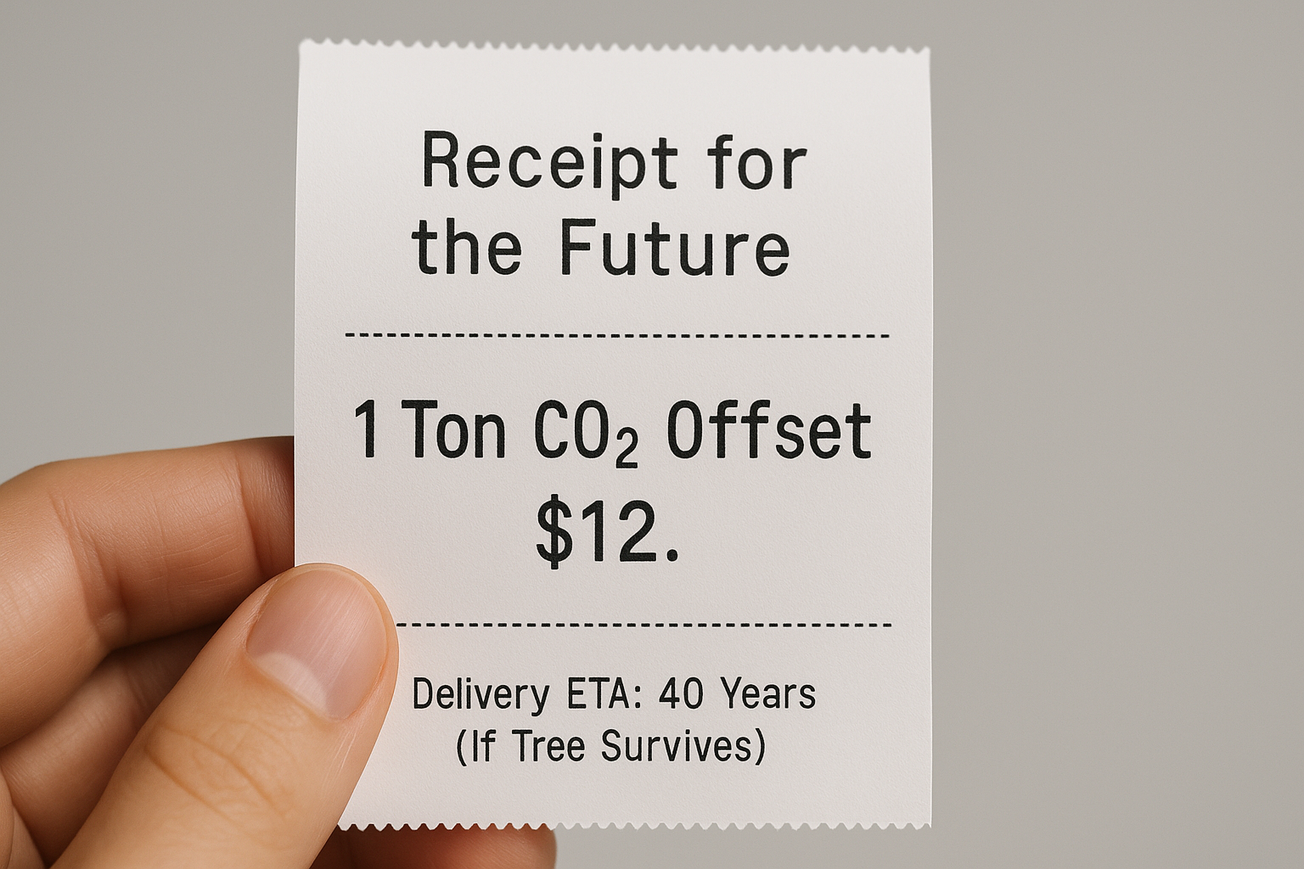

Each credit and allowance (jointly referred to as “permits,” in this article) is denominated as “1 ton in CO2-equivalents” or “1TCO2e”. A credit purportedly represents 1TCO2e worth of voluntary reduction in reportable, auditable greenhouse gas (“GHG”) inventories. An allowance is a perpetually bankable government-created permit to freely discharge 1TCO2e. It has been disheartening to discover that a substantial portion of the VCM CO2 credits and a large share of the CO2 allowances that our governments have minted and released into circulation to date lack genuine underlying GHG reduction value.

Conservative analysis of data in the public domain suggests that over 60% of VCM credits and more than 80% of the surplus allowances governments have created and given away, or auctioned, fail to have any tangible underlying emission reduction value. When factoring in a generous "quality" factor, actual reductions underlying the credits and allowances that have been created and remain in circulation at this time might offset less than 15% of the Scope 1 and Scope 3 GHGs that were discharged by less than 100 companies, worldwide, in 2023.

Looking at it from another perspective, the carbon markets we have developed, to date, have offset less than one percent of the Scope 1 and Scope 3 GHGs released by only eight well-known oil companies between 1998 (the year after the launch of the Kyoto Protocol) and 2015 (the year we adopted the Paris Agreement). In other words, the greenhouse gas emission reduction value underlying more than 20 years of voluntary registry-led and government-administered carbon markets, combined, is statistically insignificant.

Furthermore, reliance on greenhouse gas estimates that are reported publicly must be approached with caution. These estimates often understate total emissions, leading to misleading conclusions about corporate environmental performance. The single largest source of misleading greenhouse gas reporting is the failure of global accounting standards-setting bodies to reach agreement on a reasonable approach to greenhouse gas inventory and CO2 permit accounting standards—despite the fact that these standards-setting bodies started meeting to discuss the need for such standards since 2002.

The implications of these shortcomings are profound. Carbon markets, intended as a mechanism to incentivize emissions reductions, are failing to deliver meaningful results. For some observers, the carbon market experiments we have executed to date provide a false sense of progress, while allowing polluters to evade genuine accountability. For others, confidence that any market-based greenhouse gas reduction measures have been eroded—perhaps beyond repair. As the urgency of addressing climate change grows, it is imperative to confront these challenges head-on and to quickly overhaul existing frameworks to ensure transparency and integrity.

Ultimately, the effectiveness of carbon markets hinges on their ability to drive tangible reductions in atmospheric concentrations of heat trapping gases. To achieve this goal, we must confront the shortcomings exposed by recent analyses and commit to building a more transparent, accountable, and equitable framework for carbon trading. The time for action is now, lest we risk squandering valuable opportunities to combat climate change and safeguard the future of our planet.