A recent proposal by the California Public Utilities Commission that claims will ease customer’s electric bill burden by changing the way customers of the state’s big three investor-owned utilities are billed, is a very bad idea. California electricity rates--when accounting for all included charges, taxes and levies--are not just the highest in the United States. They are among the highest in the world! Only Denmark and Germany are higher. This new proposal ignores a much more efficient and equitable approach and will only discourage green energy investment while driving rates higher.

Charges in Our Utility Bills

Every electricity, natural gas and district energy (where districting heating exists) utility bill includes a list of charges, some of which appear to be based on how much energy you use, and some of which appear as fixed rate (monthly) charges. Typically, a significant share of the costs you see in your bill look like they are demand-based. They are denominated in dollars per kWh (electricity or heat) or per mmBTU (natural gas, propane, etc.). The charges that are communicated in this way look like they are variable costs--and most customers would reasonably expect to see all of such denominated charges shrink if they find a way to consume less energy.

But the only cost that is truly variable in your energy supply chain is the cost of producing the electricity, gas or heat. (And those production costs are not always variable, as we discuss in greater detail below). Almost all other costs of getting energy to your house are largely "fixed costs", regardless of how they are communicated in your utility bill. The cost per delivered kWh of maintaining a transmission line to serve a given region's demand for 1,000 million MWhs of electricity might not go down--and might even go up--if the electricity demand from that region shrinks by 50%. It depends on many factors, including the technical design of the existing transmission and distribution infrastructure, how connected it is to other demand hubs, how old it is and how easy it is to replace. The costs of maintaining and collecting data from your gas meter are the same, no matter how much gas you consume. The administration costs of maintaining your account, billing and collecting are roughly the same, for each account, no matter how much energy you consume.

In general, somewhere between 70% and 85% of the costs of getting energy to your door and maintaining your account(s) are currently fixed costs, even though the way those costs appear in your utility bill might lead you to believe that as much as 75% of the costs your bill covers are variable.

What Happens to the Fixed Charge as Demand Patterns Change

If only 2% or 3% of the customer base successfully invests in energy efficiency and grid independence, customers usually do not see any significant increase in the fixed cost portion of their utility bills. The householders who invested wisely might initially see a big reduction in their utility bills. If they cut their reliance on grid supply by, say, 50%, they see a 50% reduction in the 75% of the charges in their bill that are communicated in /kWh terms.

But if larger shares of the total customer base were to successfully invest in energy efficiency and independence, the utility has no choice but to significantly increase the share of fixed cost charges in all customers' utility bills. That is because, in real life, if, say, 80% of the utility's costs are actually fixed, and their customers reduce their combined demand by 50%, the consumers' demand reduction might translate into only a 50% x 20% = 10% reduction in the utility's cost of serving the customer base. So as more customers reduce demand, there has to be an increase in the fixed costs that are allocated to all customers' bills. Reducing your energy demand by 50% will rarely translate into a 50% reduction in your utility bills, over the longer term, especially as more and more customers also invest in efficiency and/or becoming less grid-dependent.

Some utilities and governments like to spin the idea that shifting some of the portion of your bill that has historically looked like a variable cost to a low, fixed charge is efficient and fair, and the new fixed charge can be small.

But, as more and more customers invest in efficiency and getting off-grid, that fixed charge must get bigger and bigger. In the jurisdictions and utilities that were early adopters of this billing format, the fixed cost share of consumers' electricity and heating bills now makeup anywhere from 56% to 80% of customers' total bills. Which, of course, means that customers are not realizing anywhere near the utility cost savings they thought they would realize before they invested to reduce their energy and heat demand. You pay the fixed cost portion of the bill no matter what your demand is.

As an extreme example, in the 1990s, Denmark even legislated something they call the "obligation to connect" or "connection obligation". The purpose was to make uneconomic district heating systems appear to be competitive. In Denmark, if a district heating company knocks on your door and demands the right to connect your household to the local District Heat system, you must allow them to do so and you also must pay the connection charge they bill you for. You do not have to buy heat from the local DH provider, but you must pay the fixed charges in the monthly bill you receive, even if you never use the system.

Customers need to appreciate the downside of accepting proposals to increase the fixed cost portion of a utility bill, to apparently offset a variable cost in that same utility bill. Any such fixed cost is, by definition, a regressive form of public service cost reallocation. Any fixed--not energy use-weighted--charges in utility bills eat up proportionately more of poor households' disposable incomes than rich households' disposable incomes. The wealthiest 40% of households have 5 to 8 times the net disposable income of the 40% poorest households. But they consume less than 2 times as much energy. It is certainly possible to design fixed charges or a fixed rate CO2 tax regime in a manner that does not, effectively, result in a more regressive allocation of public service costs, across the economy as a whole.

And There is an Elephant in the Room...

There is also a huge elephant in this room. If/when governments guarantee prices and revenues to select energy producers--e.g. to incent investment in solar, wind, renewable natural gas, hydrogen--those guarantees have the effect of converting more of the share of some of the total cost of energy supply from variable to fixed, at least for the terms of the agreement’s governments approve to guarantee revenues for the green supply project investors.

So as long as we are using Feed In Tariffs (FITs) or similar approaches to guarantee revenues to incentivize investment in greener supply, this practice can cause a major shift in the true variable/fixed cost ratio for our overall energy supply chains. There are past cases where governments' aggressive use of FITs or other supplier income guarantee structures have, effectively, caused the fixed cost share of the overall energy supply system grow to 90% to 95%. That means the customers' utility bill returns on investments in efficiency will ultimately shrink to the point that they realize almost no household operating cost savings in return for their private investments in efficiency and grid-independence. The more our governments directly subsidize new low-emissions energy supply using these policies/measures, the smaller the utility bill and/or "occupancy cost" (property tax, etc.) savings the average householder is going to realize on their private investments.

There are green/clean energy policies and measures that we should be introducing that do not have this perverse effect. Why are we not talking about those alternative options?

The Other Elephant(s)...

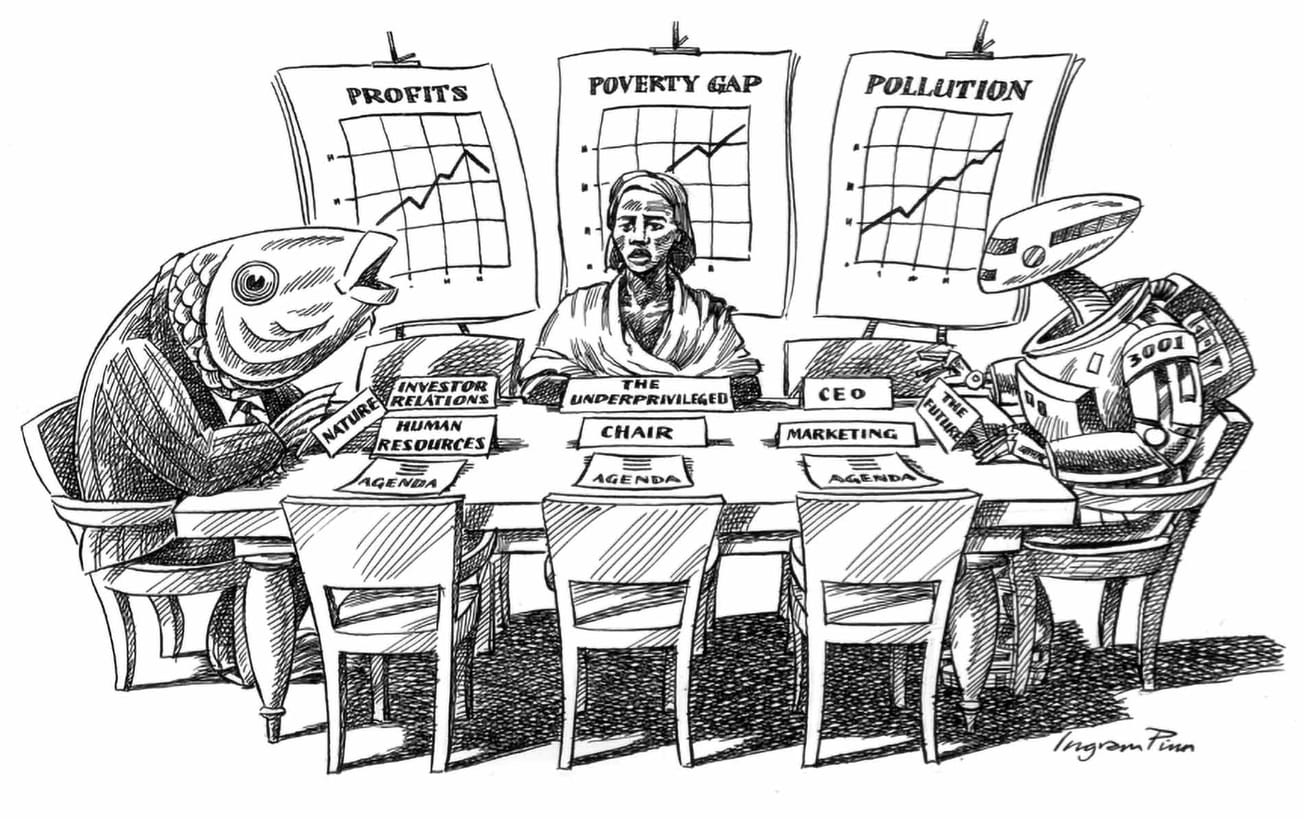

In a majority of developed economies, electricity, gas and heat market regulators have approved utilities' long-established practice of allocating a share of the costs of delivering energy and heat to large industrial and larger commercial customers into the utility bills sent to households and small business customers. In Canada and the United States, on average, the average rate (all charges, levies and taxes included) a refinery operator pays for natural gas or electricity is a little less than 50% of the rate that the smaller customers pay for the same heat or power. It does cost the utility company less, per MWh or mmBTU of delivered service, to supply the big industrial customer than it costs to deliver services to the more widely-dispersed small customers. But the real cost difference is not, typically, as much as the 50% price differential. In most jurisdictions, we currently see regulators approving the packing of some of the costs of building LNG processing, related gas pipeline, LNG storage and distribution infrastructure into residential and small business customer bills, even though the end goal is to supply the LNG to offshore markets and local large industry and commercial truck fleet operators.

And then there is the impact of the addition of Cap and Trade ("C&T") regulations on top of this much longer-standing industrial cost-sharing practice. Why do EU nation leaders utilize C&T as a GHG control measure? Back in 2004/5, when EU and the UK governments first introduced C&T, many of them also introduced electricity and natural gas utility regulations mandating that 100% of the utilities' costs of complying with C&T regulations must be passed through to residential and small business customers only, and may not be added into large industrial customer utility bills. Thus governments raise revenues by selling greenhouse gas quota ("CO2 allowances") to utilities and large industrial emitters, where utilities typically account for more than 50% of GHG quota demand. Then 100% of the utilities' GHG quota purchase costs are allocated to residential and small business customers. That translates into even greater net transfers of policy-induced industrial costs to the residential and small business rate-payers.

In some countries that have been implementing all of these strategies for a while, the residential and small business customer bases are now paying a huge share of large industries' energy use costs. In Norway and Sweden, for example, the small, efficient household pays, on average, 4 to 6 times the price a refinery pays for the same electricity or heat.

Of course, governments love these approaches. This combination of policies/strategies enables governments to mint and sell huge GHG quota surpluses and use revenues from the sale of the minted-out-of-the-air GHG quota to create huge new subsidies for large, energy-intensive industries, which subsidies are paid for, in real time, by small utility customers. Governments get to claim to be addressing climate change risk, while delivering massive new fossil fuel subsidies to large, energy-intensive industries, and none of the cost of doing so translates into government deficits or debt. It all shows up in residential utility bills. This long-standing practice has resulted in Norway and Denmark jumping to the top of the list of OECD nations ranked in terms of household debt as a % of disposable household income. How is that for an innovative and sleight-of-hand approach to social capitalism?

The Inevitable Energy Market Crash

How does this combination of policies/strategies ultimately play out? We will see, pretty soon.

We now have governments, around the world, that have banned or are planning to ban the supply of natural gas to residential and small commercial building owners by 2030 or 2035. All anyone is talking about, now, is electricity-powered heat pumps, deemed to have the capacity to eliminate household natural gas demand and reduce household electricity demand, as well. What happens to the utilities' balance sheets and or large industrial energy input costs when residential demand for natural gas is wiped out and if/as residential electricity demand shrinks? How will our governments replace the long-standing and increasingly significant backdoor residential customer cross-subsidies for large industrial energy users? Will it be new taxes on electric vehicles and the electricity used to power them?

I guess we will see.

Or, we could sit down and agree to a more rational, efficient, transparent policy package, before the industrial energy price crisis hits.